Documentation >

MAC-PAC Reference Library >

Financials >

Accounts Receivable >

Key Concepts and Procedures >

Description

Description

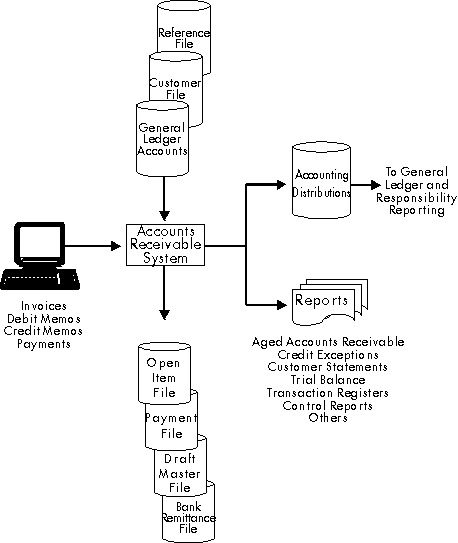

The following figure illustrates the processing performed by the Accounts Receivable module. Input to the module includes customer invoices (installments can be generated for invoices), debit/credit memos, cash sales, customer payments (checks, bills of exchange, bills of order, write-offs, chargebacks), and corrections to previously-entered documents. All transactions can be entered by an operator at a terminal to provide full online validation. Invoices, debit/credit memos, and payments can be processed from an external source of information.

Input data is matched with information contained on key Accounts Receivable files during system processing. The Customer File provides general customer information (name, address, phone number), current customer accounts receivable information, and order entry data such as ship-to addresses, discount terms, and applicable taxes. A screen of 24 additional fields is available for storing user-defined information on the Customer Master File. Unpaid invoices and other charges are maintained on the Open Item File; the Payment File contains all payments or credits applied to the invoices. The Reference File, shared by all applications, stores reference data, user processing options, and program control data.

Accounting transactions are generated and formatted automatically for distribution to the General Ledger module. They also can be reformatted for processing by other general accounting systems. Customer statements, trial balance reports, and credit exceptions, aging and other control reports are prepared.

System Overview

Accounts Receivable Processing

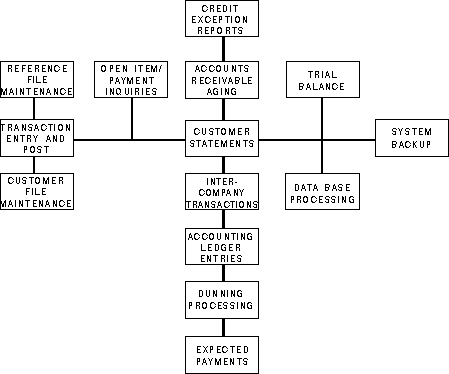

The Accounts Receivable module consists of 14 integrated applications that perform all accounting and report preparation functions. These modules and the general sequence of system processing are shown in the following figure. Key functions, such as transaction entry and posting and customer statement preparation, are discussed on the following pages.

Management Reporting

If you are using the MAC-PAC General Ledger module, you may set-up your financial system to distinguish between fiscal and managerial accounting transactions by defining two different types of accounts (fiscal and managerial). Fiscal accounting transactions are those subject to legal requirements while managerial accounting transactions are subject to internally defined requirements.

If you set-up your financial system for managerial reporting, you must define a reporting class (fiscal, managerial, or common) for the Accounts Receivable subsystem. The reporting class determines which types of accounting transactions can be made in the subsystem, and is assigned on Reference File category 026, Subsystem Reporting Class.

For a fiscal subsystem, only fiscal accounting transactions are allowed. For a managerial subsystem, only managerial accounting transactions are allowed. For a common subsystem, all types of accounting transactions are allowed. Usually, when the management reporting option is chosen, the Accounts Receivable sub-system is set-up with a common reporting class (C) to allow all transactions to be made in it.

Note: If you are using the management reporting option, please read Management Reporting in the Key Concepts section of the General Ledger User Manual before you set-up the Accounts Receivable system.

Processing Applications

Processing Applications Relationships

Multiple Entity Support

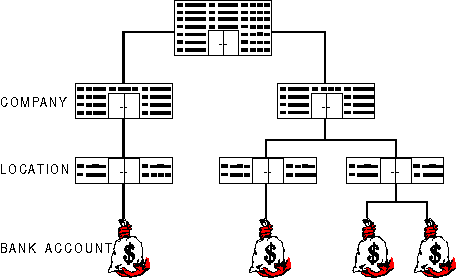

The Accounts Receivable module processes customer invoice and payment information according to the company, location, or division structure that best defines an organization's credit collection accounting and reporting hierarchy. Multiple locations can be specified for each company, as illustrated below.

Separate processing is performed for each company-location This feature allows users to specify processing and reporting options based on the unique characteristics, requirements, and schedule of each business entity.

The companies and locations defined in the Accounts Receivable module should be consistent with those defined in the General Ledger module. This setup helps automate the distribution of accounts receivable accounting entries.

Credit Collection Accounting and Reporting Hierarchy

Invoice Processing

Customer invoice transactions are entered through an online data entry conversation. The conversation screen used to enter invoice distribution transactions is illustrated in the following figure. Debit or credit memos related to specific invoices or stand-alone transactions and cash sales also can be entered through this conversation. Full validation and posting is performed online, ensuring that system users can always access the most up-to-date customer data. Invoice transactions generated from the Order Processing module can be inquired upon using this conversation.

When an invoice is entered, discount amounts can be represented as actual currency amounts or they can be calculated based on the payment terms arranged for the customer. The payment terms also specify whether installments will be generated for an invoice. When an invoice is entered with payment terms that generate installments, the installments can be viewed through the invoice entry conversation.

When an invoice is entered with a bill of exchange payment type, a draft is automatically created to cover the invoice. The draft receives a system-assigned number which is retrieved from Reference File category F37 and the draft and invoice are cross-referenced (the invoice number field appears on the draft and vice versa). The due date of the draft equals the due date of the invoice.

In order to assign a sequential number to each VAT document, you may set-up your Accounts Receivable system to assign a sequential fiscal number to each invoice through the Control Fiscal Number flag on Reference File category 300 (A/R System Defaults). If this option is used, the fiscal number is the same as the document number, and the Document Number flag on category 300 should be set to B (both automatic and manual) to allow the fiscal/document number to be entered manually if necessary.

The account distribution for an invoice, debit / credit memo, or cash sale transaction is identified at the time the transaction is entered. System controls ensure all items are valid and in balance. Invoices representing future assets may be entered at any time. The system ensures these future transactions are recorded and distributed to the General Ledger module (or another general accounting system) in the appropriate periods.

A batch open item conversation is also available to interface other applications to the accounts receivable module.

WILLIAMS INVOICE AND DR/CR MEMO ENTRY USD 11/09/92

DSP01 TRANSACTION DETAIL ENTER

Roll 4

Customer ABC00000001 ABC MANUFACTURING Dc Dt 11/09/92 Batch

Document IN INV00001 Co/Loc 001 BRU ANDERSEN SOFTWARE - BRUSSELS

Items Quantity Gross Amount VAT Amount Discount

Head. 2 20.000 45,000.00

Det. 2 20.000 45,000.00 .00 .00

Account Center Distribution Amt Ref1 Ref2 Distribution Desc Disc

Account Desc VAT Code Quantity Part Number UM

4130 C4 25,000.00 N

EXPORT SALES 17.000 EA

4130 C4 20,000.00 N

EXPORT SALES 3.000 EA

.00

.000

.00

.000

F4=Prompt F13=Cancel Tran F16=Review Header

F20=Installment F22=End Tran

|

Invoice Entry Detail Screen

Payment Processing

Customer payment transactions also are entered through an online data entry conversation. As with invoice transactions, full validation and posting are performed online, ensuring that current customer information is always available to system users. Cash can be applied to open items generated from both the Accounts Receivable module and the Order Processing module. Payments received from a corporate entity may be recorded and applied to invoices associated with the corporate customer using the Corporate Payment Entry Screen.

The payment conversation also provides an Open Item List Screen that allows users to apply cash payments in several ways. Payments can be applied to a specific invoice, to a portion of one or more invoices, or to the oldest open items. Any payment not applied to a specific invoice is posted automatically to a customer on-account record. In addition, write-offs, chargebacks, and clearing debit/credit memo transactions can be applied against specific invoices. The Open Item List Screen is shown in the following figure.

Bills of exchange that are created at the same time as the customer invoice can be applied to the original invoice for which it was created, to a list of open items, to a list of open items for a specific statement number, or the oldest items. When a draft is used to pay an invoice during payment application, the transaction amount is moved from Accounts Receivable into Drafts Receivable, and the open amount of the invoice is reduced by the amount of the draft. A batch application program allows you to automatically apply pre-approved bills of exchange to their corresponding invoices.

Installments generated for a customer invoice are treated the same as any other open item, and appear on the Open Item List screen for payment selection as shown in the following figure. You may apply payments, write-offs, chargebacks, and clearing debit/credit memo transactions to installments as you would any open item. Installments are identified by the invoice number and a three-digit sequence code corresponding to the specific installment.

If fiscal numbering is used, a fiscal number is only generated for payment transactions if VAT is generated or recalculated as a result of the payment. The fiscal number is generated during the VAT extract process, not when the transaction is entered.

A batch payment conversation is also available that allows payments via other media to be applied to customer documents, either by applying them to the oldest documents or by placing them on-account for later application.

WILLIAMS PAYMENT ENTRY AND APPLICATION 5/21/96

DSPO1 OPEN ITEM LIST LIST

Pmt Amt .00

Customer C01 001 BRU Due Date 0/00/00 Applied .00

Cust Nme ANDERSEN MANUFACTURING Chrgbck .00

Payment CK CSS-F1 BEF Pmt Date 5/21/96 Ded Amt .00

On-Acct .00

Pay Document Stat Amount Open Disc Avail Due Date

Co Loc Inst Applied Discount Taken Writeoff/Chgbck Dsc Date Cur

Sales Order Number Customer PO Number

IN TO304001 OPEN 43.68 .00 3/31/96

IN TO306001 OPEN 110.00 .00 3/31/96

CR 00000012 OPEN 20.00- .00 4/30/96

CR 00000013 OPEN 4.00- .00 4/30/96

CR 00000015 OPEN 11,000,110.00- .00 4/30/96

CR 00000016 OPEN 11.10- .00 4/30/96

CR 00000017 OPEN 100.00- .00 4/30/96

DR 00000003 OPEN 30.00 .00 4/30/96

DR 00000004 OPEN 30.00 .00 4/30/96 +

D - Detail G - Gross N - Net C - Reset

F4=Prompt F6=Fold/Truncate F9=Applications F12=Apply to Oldest

F13=Cancel Tran F14=A/R Inquiry F16=Review Header F21=Deductions

F22=End Tran F23=End Trn/On Acct

|

Open Item List Screen

Credit Management Information

A combination of credit management reports and online conversations provides Accounts Receivable module users with an interactive tool for managing credit information.

The Accounts Receivable Inquiry conversation allows system operators to review up-to-date customer credit information, including payment history, outstanding invoices, and aged amounts. A flexible customer search facility retrieves customer data based on unique user-defined search values, such as customer name or zip code, when the customer number is not known. To help focus your attention, you can choose to view all items for a customer or only those items that are open. The conversation screen used to review customer accounts receivable information is illustrated below.

WILLIAMS ACCOUNTS RECEIVABLE INQUIRY BEF 2/27/93

DSP01 CUSTOMER PERFORMANCE INFORMATION

Co Loc 001 BRU

Customer ABC00000001 ABC MANUFACTURING

Future 726,071.00 Past due 37,199,848.00

Current .00 YTD Write-Offs .00

1 to 30 days .00 YTD Chargebacks .00

31 to 60 days .00 YTD Discounts .00

61 to 90 days .00 YTD Cash Sales .00

Over 90 days 37,199,848.00 YTD Sales 17,296.00

------------------

A/R Balance 36,584,730.00 Credit Limit 5,000,000

On-Acct 90,830.00 Maximum Order Amount 0

Net Balance Due 36,493,900.00 Credit Contact NICK OWCHAR

Not Due Drafts .00 Phone 714-626-5650 Ext

On Order Balance 46,391.78 Aging As Of Date 12/04/92

Pending Invoice 15,240.00 Last Payment Date 2/04/93

Total Commitment 36,555,531.78

F3=Exit F11=Customer Aging F16=Selection F17=Notes

F18=Next Cust F20=Sales Stats F21=A/R Acrs Co/Loc F24=More Keys

|

Accounts Receivable Inquiry Screen

Comprehensive credit information is contained on several credit reports produced by the Accounts Receivable module. The Credit Exceptions Report lists all customers with accounts receivable balances that are overdue or greater than their credit limits. The Accounts Receivable Aging Report lists outstanding customer balances in one of six user-specified aging categories. Customer Statements, which show each transaction for the current accounting period and any charges still open from prior periods, can be prepared on either an open item or balance forward basis. These reports also calculate draft receivables per customer. In addition, flexible cycle billing permits users to bill their customers according to a timetable suited for each customer. Billing can be in the middle of the month, twice a month, once a quarter, or on any other user-specified schedules.

Customer Processing

The Accounts Receivable module maintains standard and historical data for all active customers. All invoice and payment information is kept at the customer level. Complete customer history information is available online or through a range of customer and credit reports prepared by the system.

Accounting Distribution

The Accounts Receivable module supports the recording, balancing, generation, and distribution of general ledger accounting transactions. These transactions are formatted automatically for distribution to the General Ledger module, or they can be reformatted for distribution to another general accounting system.

All accounting distribution transactions are balanced at the time of entry to ensure debits equal credits. The system automatically generates entries to standard accounts, such as cash and accounts receivable control. Distribution transactions can be generated at a detail level or summarized for selected accounts. The General Ledger Distribution Report lists the detail transactions passed to the General Ledger module as of the accounting period-end.

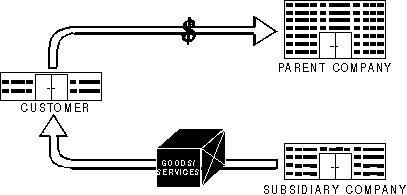

To allow payments recorded by one company/location to be applied against invoices posted to another company/location, the Accounts Receivable module automatically generates intercompany receivable and payable transactions, as illustrated below.

Intercompany Receivable and Payable Transactions

The Accounts Receivable module supports either 12 or 13 accounting periods per year. The number of periods in a year and the current accounting period can vary by location. Future period transactions can be entered and held for distribution until the appropriate accounting periods.

The module also supports multiple accounts receivable control accounts. Reconciliation of these accounts is simplified by an accrual-basis Accounts Receivable Trial Balance Report prepared for each location defined in the system. This report lists all open invoices recorded by a user-specified cutoff date.

International Processing

The Accounts Receivable module provides three features that support the processing needs of international organizations. Currency conversion is performed for users whose business transactions encompass more than one currency. Each entity (company or location) in the organization may define its own base currency. Accounts Receivable reports and inquiries present information in the base currency of the relevant entity. Customer transactions received in a currency other than the user's base currency are converted for posting and reporting in the base currency. Optionally, a single customer may be permitted to perform transactions in multiple currencies. All customer transaction information may be viewed either in the document currency or the user's base currency.

The system allows selected reports to be printed in both base and foreign currencies. These reports include the Multiple Currency Accounts Receivable Trial Balance, illustrated in the following figure.

In addition, the system supports the processing needs of users requiring value added tax (VAT) processing. Multiple VAT amounts may be recorded against a single invoice. Suspended and exonerated VAT are supported, as are VAT charged on gift items, VAT correction for write-offs, and prices with VAT included. The system provides optional features for processing VAT when payment is recorded against an invoice. The system will automatically record VAT that is declarable upon payment and will recalculate the VAT charge if payment is received net of a cash discount. The system generates accounting transactions for posting to user-specified VAT accounts and maintains a history of all VAT transactions generated.

In some European countries, documents and payments need to managed in the software such that: (1) when a document is created, a dedicated sector has to be used for recording the document; and (2) when the payment is applied, the payment fiscal number has to be assigned and the taxable amount, non-taxable amount, and taxpayer ID have to be formatted for the VAT record on the Accounting Transaction file.

For countries that need to manage documents and payments in such a way, payment time VAT review processing can be specified. For more information about Payment Time VAT Review processing, refer to the VAT key concept in this manual.

The system also supports GST processing. In a goods and services tax environment, relevant modules process goods and services tax and provincial sales taxes. This processing is handled similar to VAT except the net and recalculation method, suspended GST type, VAT on gifts, and payment declaration point is not allowed. Provincial sales taxes are calculated manually and entered on the multi-line tax fields of the recap screen.

DATE 02/25/92 CO 001 ANDERSEN SOFTWARE EUROPE PAGE 1

TIME 15:34:22 LOC BER ANDERSEN SOFTWARE - BERLIN

AR560

MULTIPLE CURRENCY ACCOUNTS RECEIVABLE TRIAL BALANCE AS OF 02/25/92

BASE CURRENCY: DEM GERMAN MARK DOCUMENT/

CUR CODE A/R CODE ACCOUNT CENTER CUSTOMER PAYMENT ACCT DATE BASE CURR GROSS FOREIGN CURR GROSS

--------- -------- ---------- ---------- ------------ ----------- ---------- ------------------- --------------------

BEF A1 1220 C1 C01 - IN-12041631 02/16/92 3.63 81.00

C02 - IN-L-21-2 02/21/92 79.99 1,800.00

C02 - IN-00000162 01/18/92 88.00 1,956.00

C02 - IN-00000372 02/18/92 1.37 31.00

C02 - IN-00000373 02/18/92 40.90 920.00

C02 - IN-00000428 02/21/92 .48 11.00

C02 - IN-00000429 02/21/92 1.32 30.00

C02 - IN-00000432 02/21/92 1.32 30.00

C02 - IN-00000438 02/21/92 1.38 31.00

C02 - IN-00000441 02/21/92 .76 17.00

C03 - DC-DCZ00007 11/27/91 7,900.86 176,595.00

C03 - DC-DCZ00008 11/21/91 4,474.00CR 100,000.00CR

C04 - IN-CL0001-2 11/02/91 51.45 1,150.00

C05 - DC-DCZ00003 02/16/92 764.20 17,081.00

C05 - IN-L-21-4 02/21/92 111.11 2,500.00

C05 - IN-STCO0021 02/20/92 55.79 1,247.00

C10 - IN-WN2 12/18/91 447.40 10,000.00

C10 - IN-W1 02/16/92 433.13 9,681.00

STBATP04- IN-STBATP73 12/01/91 7,896.57 176,499.00

STBATP05- IN-STBATP78 12/01/91 8,053.20 180,000.00

STREG01 - IN-STREG002 01/07/92 35.79 800.00

ACCOUNT/CENTER TOTAL 21,494.65 480,460.00

C01 CK-STCORP01 12/05/91 2,460.70 55,000.00

STBATP03 CK-STTST002 12/01/91 542.90 12,134.00

ON-ACCOUNT TOTAL 73,118.80 306,848.00

CURRENCY TOTAL BELGIUM FRANCS 51,624.15CR 173,612.00

|

Multiple Currency Accounts Receivable Trial Balance